Estate Documents Most Crucial for Servicemembers

Here we go - an outline of the essential estate planning documents that are particularly important for members of the U.S. military. Given the unique circumstances and potential risks faced by our ourselves or loved ones in uniform, having a comprehensive estate plan is vital to ensure that wishes are honored and loved ones are protected. This post will cover the key documents that every service member (and their families) should consider!

1. Last Will and Testament

A Last Will and Testament is a fundamental document that outlines how a service member's assets should be distributed in the case of their death. It allows them to designate beneficiaries, appoint guardians for minor children, and specify funeral arrangements. For military personnel, having a will is crucial, especially when deployments or relocations may complicate matters.

And - not to be a downer - but accidents happen. This document should be priority, even if deployments are few or the job is generally safe.

2. Durable Power of Attorney

A Durable Power of Attorney (DPOA) grants a trusted individual the authority to make financial and legal decisions on behalf of the servicemember if they become incapacitated. This is particularly important for military members who may be deployed or face situations where they cannot manage their own affairs. It ensures that someone else can handle financial or other matters without delay.

The validity of a regular Power of Attorney immediately ends if the person granting authority becomes incapacitated, so a durable POA is often the preferred option. Consult a lawyer or your nearest base legal assistance office for assistance deciding.

3. Healthcare Power of Attorney

Similar to a DPOA, a Healthcare Power of Attorney designates someone to make medical decisions on behalf of the service member if they are unable to do so. This document is essential for ensuring that medical preferences are honored, especially in high-stress situations that may arise during military service.

4. Living Will

A Living Will, or advance directive, outlines a service member's wishes regarding medical treatment in the event they are terminally ill or incapacitated. This document provides guidance to healthcare providers and family members, ensuring that the service member's preferences are respected during critical moments.

This includes choosing preferred treatments if your life is threatened, or any DNR (Do Not Resuscitate) instructions.

5. Beneficiary Designations

For military personnel, it is crucial to regularly review and update beneficiary designations on life insurance policies, retirement accounts, and other financial assets. These designations generally supersede wills, so ensuring they are current and reflect the service member's wishes is vital for providing for loved ones.

We suggest scheduling an event - officially, in your Gmail or Outlook calendar or wherever you won't forget - at least 1-2x per year to review beneficiary designations on your policies and accounts. Include your spouse, any parents involved, other trusted family members or those with your DPOA/POA so everyone is on the same page and up-to-date with your plans and wishes.

6. Servicemembers Civil Relief Act (SCRA) Protections

While not a traditional estate document, understanding the protections offered by the SCRA is essential for military members. This act provides various legal protections, including the ability to postpone certain civil obligations, which can impact estate planning and management.

7. Trusts

Establishing a trust can be an effective way to manage assets and provide for beneficiaries, especially for those with complex financial situations or minor children. Trusts can help avoid probate (the legal process of distributing your property and settling your debts after you die), provide privacy, and ensure that assets are distributed according to the servicemember's wishes.

Plus, some types of trust can reduce or eliminate certain taxes and even provide assistance for children with special needs or long-term medical conditions, among other benefits.

Conclusion

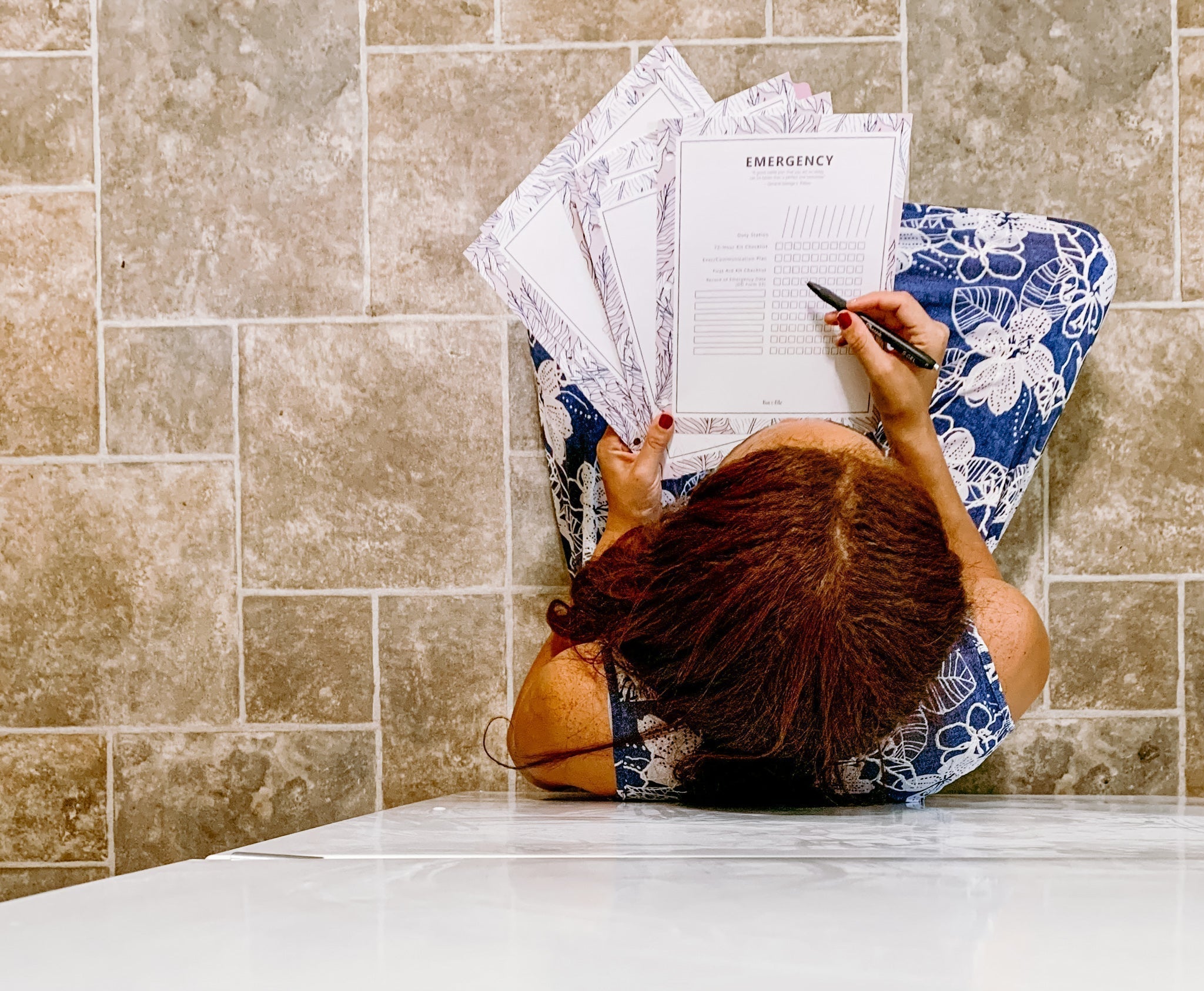

For members of the U.S. military, having a well-structured estate plan is crucial to protect their interests and those of their loved ones. By ensuring that essential documents such as wills, powers of attorney, and trusts are in place (and copies kept in a Daily Binder or Career Binder), servicemembers can have confidence and peace of mind knowing that their affairs are managed according to their wishes, regardless of the challenges they may face in their service.

Regularly reviewing and updating these documents is equally important to adapt to any changes in personal circumstances or laws, so that scheduling tip we list in #5? Do it. ;)

And don't forget - we're not lawyers! Best consult a real one or your nearest base legal assistance office with questions.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.